You can’t create a realistic budget if you don’t know where your money is going - and this is where Mint really shines. Learn More Mint vs Quicken: Unique Features Mint’s Unique Features 1. View Your banking, retirement, credit card and investment accounts all in one place. Quicken provides you with the ease to get your complete financial picture at a glance. Like Mint, these tools can be used to provide a complete picture of your personal financial situation.

MONEY MANAGER EX CONVERT FROM QUICKEN SOFTWARE

Quicken offers a robust set of personal finance tools that can be accessed via desktop budgeting software or mobile app. The service was discontinued in 2010 following Intuit’s acquisition of Mint and brought back as a subscription service when Intuit sold Quicken to H.I.G.

Like Mint, Quicken started as a free online service under its former parent company, Intuit. Mint has a tough competitor in Quicken, which is one of the most comprehensive and well-established personal finance software solutions on the market. In 2009, Intuit purchased Mint for a cool $170 million.

MONEY MANAGER EX CONVERT FROM QUICKEN ANDROID

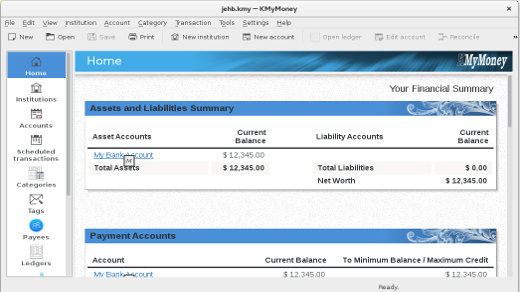

Mint is free and simple to set up and can be accessed over any PC, Mac, iPhone, iPad, or Android device. That way, you can get a bird’s-eye view of your personal finances in one place. The personal finance app pulls data from multiple sources - including checking accounts, savings accounts, investment portfolios, retirement accounts, and credit cards - into a single and easy-to-use interface. Think about Mint like your personal mobile financial dashboard. In This Article Mint vs Quicken: Overview What is Mint? Let’s explore the differences between the two to help you determine whether either one is right for you. Two such services that can help you in this regard are Mint and Quicken. There are plenty of tools available that can get you under budget and on track to reach your savings goals. The good news is that managing your personal capital doesn’t have to be difficult. Yet, for many people, this is a regular occurrence because they lack visibility into their daily expenses. There’s nothing worse than taking a look at your bank account at the end of the month and wondering where all of your hard-earned dollars went.

0 kommentar(er)

0 kommentar(er)